Strategic Analysis: Flipkart Competitive Position and Analysis

ABSTRACT

The following document primarily focusses on the competitive positioning of Flipkart. It briefly studies the state of ecommerce industry in India and its future prospect, following which it attempts to identify the major players in the ecommerce industry in India. The analysis, then, focusses on the comparisons between Flipkart and its competitors. The analysis also concentrates on the bargaining power of buyers and sellers, threat of entry of new players, threat of substitutes and intensity of rivalry. Furthermore, the study identifies possible innovations, which can cause disruption in the ecommerce industry and ways to tackle the same. Finally, the study analyzes the diversity of the products offered by Flipkart and identifies and ranks them according to their attractiveness in terms of growth.

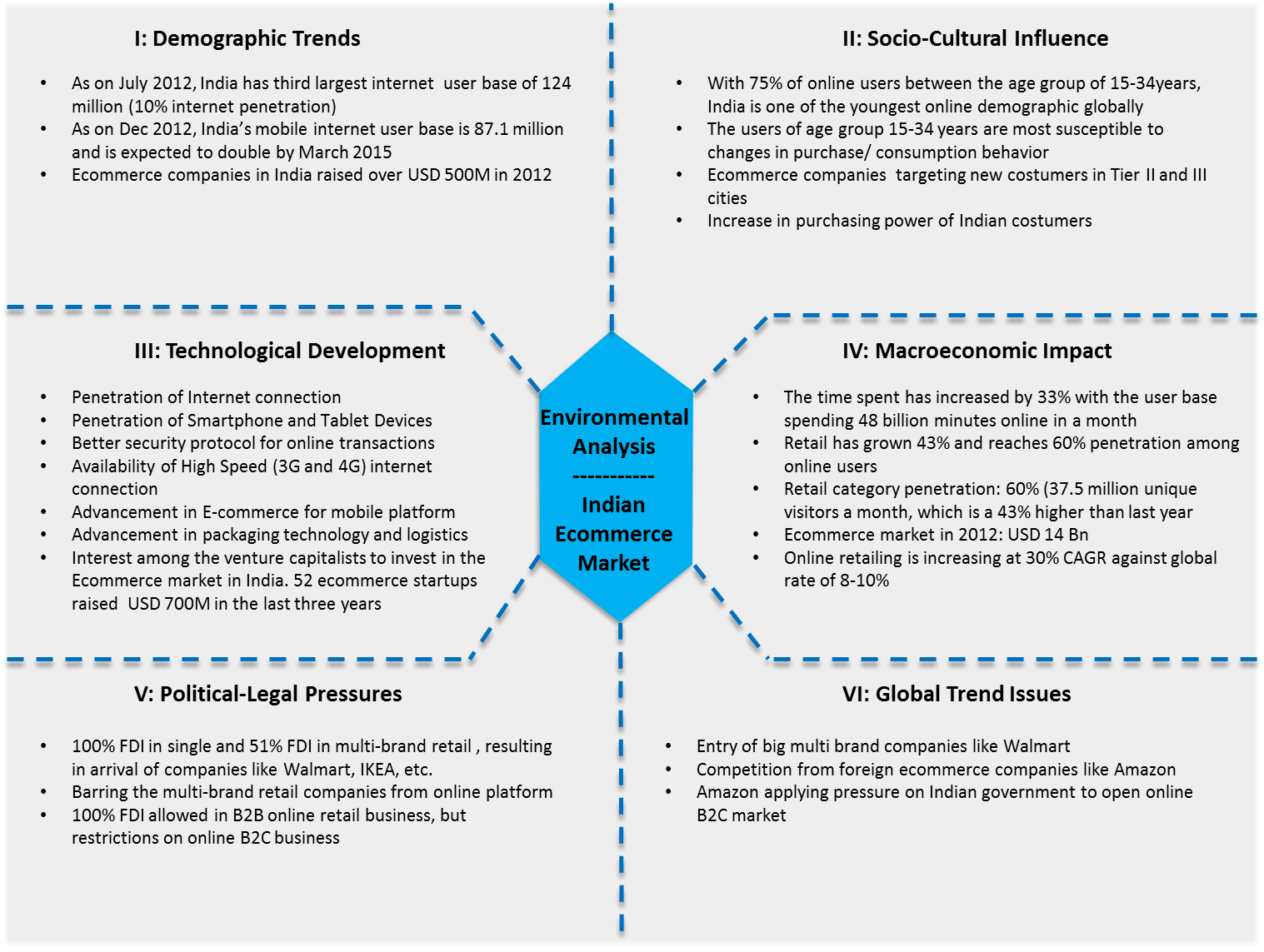

Industry Analysis (Exhibit I)

India has, perhaps, one of the fastest growing ecommerce industries in the world. Supportive policies from the government, quickly increasing internet penetration are some of the reasons contributing to this growth. But most importantly, it is the fact that majority of Indian population is young and hence most susceptible to change in the consumption and purchase behavior, contributes to the positive outlook of Indian ecommerce industry. As on July 2012, the internet penetration in India has reached 10% of the population. 75% of the online population is from 15-34 age groups, which is driving the success of the industry. According to Assocham - Comscore report, retail category penetration has increased to 60% reach and has grown to 37.5 million unique visitors a month, an overall growth of 43% annually. The many of the top retail sites have seen a growth of over 100% in the last 12 months. While Flipkart leads the way among the online retailers in India with 7.4 million unique visitors a month, growing at 431% annually, Snapdeal has been close second with 6.9 million unique visitors. Jabong and Myntra have been competing closely in the lifestyle category with over 5.3 million unique visitors’ each.

Talking of the current scenario of the ecommerce market, it is a mix of success and failure stories. Independent experts have estimated e-commerce segment to have more than doubled in India to about USD 14 billion in 2012 from USD 6.3 billion in 2011. However, ecommerce companies face a unique challenge of convincing people to accept a new mode of shopping. The market is at a point, where the companies need to experiment around to attract customers’ interest. As a result of this, many small players have tried and failed in this field. But more players are entering the market, learning from the mistakes of their and that of others. This has led to some limited number of business models, which are successful in this market.

In Exhibit II, we study the strengths and weakness of ecommerce industry in general and Flipkart in particular while accessing the opportunities and threats associated with the same. Some important takeaways from that analysis are:

- Start taking m-commerce seriously

- Build applications and/or website for mobile platform

- Develop and include mobile payment as one of the payment options

- Target the young. Connect with the young generation through a robust social media presence

- Increase the reach of the services and enter the untapped market of tier II & III cities

- Tie up with authors to increase competitive advantage in the online books market

- Tie up with educational institutes to attract bulk orders

- Do away with 35% dependence on courier services and build an independent logistic/ delivery network as it is one of Flipkart’s competitive advantages.

- Educate people to make a safe online payment. Tie up with banks to simplify the payment procedures and make them more trustworthy

- Price high value products more competitively to encourage its purchase, which would increase the average transaction value

- Keep experimenting with various payment methods

- Acquire small players doing business in niche areasIn Exhibit III, we do porter’s five forces analysis to understand the competitive position of Flipkart. This analysis is necessary to understand the bargaining power of Flipkart’s buyers and suppliers and understanding the threat from substitutes and entry of new players in the market

Key Takeaways:

- Flipkart should capitalize on their early presence in the market and leverage their reputation for superior customer service and delivery network to their advantage

- Treat suppliers as partners but make only short term contracts, as the customer behavior towards a product can be very transitory

- Use predictive analytics to predict a product’s demand in the future. This is important as Flipkart follows an inventory-based business model and they need to keep their inventory in line with the future demand

- Increasing reach to Tier II and Tier III cities will make Flipkart more attractive for the suppliers, enhancing Flipkart’s bargaining power

- Increase the switching cost for the buyers by offering them heavy discounts and exclusive offers through online wallet facilities

- Increase engagement with the potential customers through social media to increase their exposure with Flipkart

- Tie up with traditional retail stores to leverage their trust and collective reach in the market.

- Infibeam is doing this through their ‘Build a Bazaar’ Initiative

In Exhibit IV, we conduct a competitive life cycle analysis to identify those innovations, which can affect the ecommerce industry. Among developments in User Interface, Human Computer Interaction, etc., M-commerce is a market, which can actually disrupt the ecommerce market and hence, is something that Flipkart should be wary of. Flipkart offers a wide range of products through their website.

In the Diversification matrices (Exhibit V), Flipkart’s range of product offerings is classified into 16 categories. They are then mapped according to their industry’s attractiveness and the competitive advantage that Flipkart holds in that market. This helps us in identifying the product categories, which are most profitable for Flipkart. Flipkart have competitive advantage for the product categories encircled in green. As these categories belong to a high growth industry, Flipkart would do good to retain their competitive advantage here.

Yellow: Industry with high growth potential but Flipkart does not hold a competitive advantage in it. However, the future movements of the categories suggest a positive outlook for Flipkart. Hence, Flipkart would gain from concentrating on enhancing their advantage in these areas.

Red: Categories which are highly attractive. But neither does Flipkart have an advantage in this industry, nor is there any definiteness of its future growth. Flipkart would do better to concentrate on ‘yellow’ and ‘green’.

A customer evaluates an ecommerce company on various parameters. Some of the most prominent parameters are identified and used to compare the performance of Flipkart with their closest competitors (including traditional retail stores) in Exhibit VI (Competitor’s Rating). This analysis was preferred over strategy map tool because there were many parameters for comparison and, therefore,the resulting analysis would have become tedious. In addition to that, as Flipkart and their competitors are not public companies, information on their size is not easily available This analysis reflects a highly competitive nature of the market, where Flipkart is closely matched with their competitors. Nevertheless, it is observed that while Flipkart ranks highly on Customer Service and Timely Delivery, it lacks in trustworthiness and competitive pricing.

COMPETITOR'S RATING

In Exhibit VII, we conduct the competitor’s analysis of Flipkart. Although Flipkart is a private company (and so are its competitors) and financial data is not readily available, this analysis do throw some light on the competitive position of the companies, their past achievements, size of operation, and future aspirations.

COMPETITOR ANALYSIS

Flipkart

Grown rapidly because of its inorganic growth route and inventory-based business model

The worth of Flipkart has been estimated at 1 billion dollars.

In 2012, Flipkart is aiming to earn INR 500 crores

- Projections:

- Expected revenues to cross USD 100 million this year and is aiming at USD 1 billion by 2015

- Delivery network to expand to 25 cities

- Logistics and Delivery Network

- Sachin Bansal, the company’s chief executive, said that by having its own staff, FlipKart avoids paying courier services’ commissions of more than 2 percent to accept cash on delivery, which make up about 60 percent of its orders. It can also track packages more accurately. And because labor costs are relatively low in India, its delivery cost is a modest $1 a package.

Snapdeal

- Started as a coupon retail site designed on the model of the US-based Groupon

- Snapdeal works like a market place, similar to that of eBay. Brands can use the Snapdeal platform to showcase their products. When it comes to delivery, it has opted for a “fulfillment center” rather than a warehouse. The center is used only in case of a retailer not wanting to fulfill a transaction (delivery). If a retailer does not want to take the onus of shipping they can send the package to the fulfillment center of Snapdeal, and the latter ships it out

- Has chosen to depend on third-party courier firms for delivery

- Does not want to build a business which depended on creating a large inventory

- Snapdeal, has recently generated funds from investors on the basis of its valuation of 200 million dollars

Infibeam

Build a Bazaar Initiative

- Opened its IT and supply infrastructure to different retailers (both large and small), under the name of ‘Build a Bazaar’ initiative

- “This gives retailers access to our infrastructure, which includes IT support, and access to our supply chain. We have 36 courier companies integrated into our platform. We have signed up 13,000 retailers and expect this to take up to 100,000 by the end of this year” -- Vishal Mehta, CEO and Founder Infibeam

- The platform allows the retailer to sell their own products and also sell Infibeam’s product.In case Infibeam’s product are sold through another retailer’s online store on this platform, then Infibeam pays one to 1.5 per cent seller commission. If the retailers’ products are sold on any of the Infibeam portals, then the retailer gives a commission of one to five per cent to Infibeam

Other Competitors

• Jabong.com

• Yebhi.com

• Myntra.com

• Naaptol

• Fashion and You

• Indiatimes Shopping

• Junglee

• eBay

• Amazon

• Homeshop18

• Tradus.com

• Futurebazaar

Comments